WaMu Gave Grandma's Money to Crooks

special announcements

New York Times Reporting on ICT

The article appeared on May 21, 2007.

click here for more info

Thursday, March 30, 2006

how Client Care Relations works from the inside

I received this email yesterday from someone identifying himself or herself as an ex-CCR Employee. The portrait of Client Care Relations the anonymous emailer provides more or less accords with the one I've put together in working with them. What particularly galls me is the way Washington Mutual appears from its letter to cooperate with outfits like this.

In his letter, Andrew Samuel of Washington Mutual states, "The Forgery Department is very familiar with the different telemarketing companies, and knows which ones provide a recording of the verbal authorization." As the ex-CCR employee here notes, "This is not to say that people were not mislead off of the recordings... These recordings are played to the bank representatives if they call to inquire. They hear the customer’s authorization and some will not reverse transaction even if it is within 60 days.":

Google Maps: Strategic Commercial Solutions Headquarters

(As far as I can tell, not an empty lot.)

In his letter, Andrew Samuel of Washington Mutual states, "The Forgery Department is very familiar with the different telemarketing companies, and knows which ones provide a recording of the verbal authorization." As the ex-CCR employee here notes, "This is not to say that people were not mislead off of the recordings... These recordings are played to the bank representatives if they call to inquire. They hear the customer’s authorization and some will not reverse transaction even if it is within 60 days.":

I saw your blog on Client Care Relations. Regrettably, I was once employed there.

Client Care Relations claimes to provide customer service for a variety of other telemarketing firms. From what I remember they were in the business of processing customer complaints and returns for 5 or 6 different companies at a given time. Usually credit card rehabilitation, prescription drugs, and ironically anti telemarketing services.

I can confirm all sales calls were recorded and the recordings were verified by Client Care Relations quality control before any payments were processed. The sales on the recording were authentic, if a client was mislead on tape, the sale was cancelled and never processed. This is not to say that people were not mislead off of the recordings. The telemarketing industry is a dying breed, but there are still smooth sales people and unsuspecting gullible folks.

As far as things went in the office.. A client would usually call complaining either:

1- That they never ordered this (Or once the received it they were so furious or embarrassed to see what they were duped into)

2- That they never got it (Shipping was delayed all the time)

3- Sometimes people were double or triple charged.. We advised them it was a processing error..These were the priority refunds, but still took about 10 business days or more.

Customers had to return the merchandise in order to obtain a refund. It would usually take over 60 days for the client to call, then receive the merchandise and return it to a NY post office box, Someone would then have to drive to that po box and bring the merchandise back and then it had to be entered into the system. Depending on the severity of clients calls or threats.. Refunds were submitted accordingly.

Most clients had their refunds delayed until they made huge stinks with the BBB or Attorney General or the police. Some people who were promised refunds were delayed until the company disconnected the phone line and changed it to a new number. Eventually it was apparent that some people would not be refunded and we were advised to tell clients that Client care relations service contract for that particular telemarketing company had expired and to try to file chargeback’s R-10’s with their bank.

Unfortunately the time it takes to get to that point has usually exceeded 60 days and the customers can no longer file chargeback’s with their bank. In most cases the clients have agreed on tape to purchase the item on a given date for a given price. Some recordings even told customers that the product or service was not refundable. These recordings are played to the bank representatives if they call to inquire. They hear the customer’s authorization and some will not reverse transaction even if it is within 60 days.

I know that some people were indeed refunded but they left a lot of people hanging.. They would never provide the contact information for the actual telemarketing offices which leads me to believe the two are probably intertwined.

A lot of customers would just give up after getting the run around. As a result, people learn the expensive lesson not to buy ANYTHING over the phone.

They get away with it through legal technicalities and it is not right.

In an attempt to absolve myself of the some of the guilt I carry from having been employed there; I would like to offer you their actual business information in the hopes I can maybe help some people get their money back.

Strategic Commercial Solutions

83, Avenue Ashgrove,

Pointe-Claire, QC H9R 3N5

Tel. : 514-695-5311

Both Suite 201 and 202 if I remember correctly.

Please email me if you have anymore questions.

Understandably, I would like to remain anonymous.

Take care.

Client Care Relations claimes to provide customer service for a variety of other telemarketing firms. From what I remember they were in the business of processing customer complaints and returns for 5 or 6 different companies at a given time. Usually credit card rehabilitation, prescription drugs, and ironically anti telemarketing services.

I can confirm all sales calls were recorded and the recordings were verified by Client Care Relations quality control before any payments were processed. The sales on the recording were authentic, if a client was mislead on tape, the sale was cancelled and never processed. This is not to say that people were not mislead off of the recordings. The telemarketing industry is a dying breed, but there are still smooth sales people and unsuspecting gullible folks.

As far as things went in the office.. A client would usually call complaining either:

1- That they never ordered this (Or once the received it they were so furious or embarrassed to see what they were duped into)

2- That they never got it (Shipping was delayed all the time)

3- Sometimes people were double or triple charged.. We advised them it was a processing error..These were the priority refunds, but still took about 10 business days or more.

Customers had to return the merchandise in order to obtain a refund. It would usually take over 60 days for the client to call, then receive the merchandise and return it to a NY post office box, Someone would then have to drive to that po box and bring the merchandise back and then it had to be entered into the system. Depending on the severity of clients calls or threats.. Refunds were submitted accordingly.

Most clients had their refunds delayed until they made huge stinks with the BBB or Attorney General or the police. Some people who were promised refunds were delayed until the company disconnected the phone line and changed it to a new number. Eventually it was apparent that some people would not be refunded and we were advised to tell clients that Client care relations service contract for that particular telemarketing company had expired and to try to file chargeback’s R-10’s with their bank.

Unfortunately the time it takes to get to that point has usually exceeded 60 days and the customers can no longer file chargeback’s with their bank. In most cases the clients have agreed on tape to purchase the item on a given date for a given price. Some recordings even told customers that the product or service was not refundable. These recordings are played to the bank representatives if they call to inquire. They hear the customer’s authorization and some will not reverse transaction even if it is within 60 days.

I know that some people were indeed refunded but they left a lot of people hanging.. They would never provide the contact information for the actual telemarketing offices which leads me to believe the two are probably intertwined.

A lot of customers would just give up after getting the run around. As a result, people learn the expensive lesson not to buy ANYTHING over the phone.

They get away with it through legal technicalities and it is not right.

In an attempt to absolve myself of the some of the guilt I carry from having been employed there; I would like to offer you their actual business information in the hopes I can maybe help some people get their money back.

Strategic Commercial Solutions

83, Avenue Ashgrove,

Pointe-Claire, QC H9R 3N5

Tel. : 514-695-5311

Both Suite 201 and 202 if I remember correctly.

Please email me if you have anymore questions.

Understandably, I would like to remain anonymous.

Take care.

Google Maps: Strategic Commercial Solutions Headquarters

(As far as I can tell, not an empty lot.)

Monday, March 27, 2006

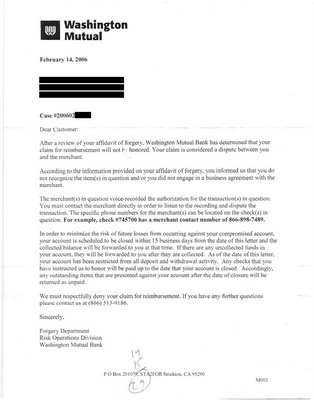

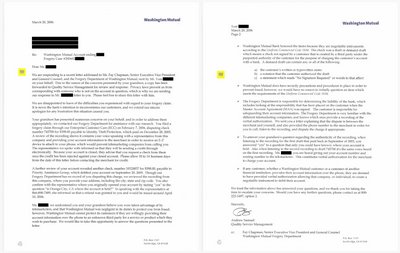

WaMu's response to my letter

Below is the response my grandmother received last week from Andrew Samuel, Quality Service Manager, to my letter to Fay Chapman, Senior Executive Vice-President and General Counsel. I apologize for not providing a larger, better quality image for those who wish to read, but I tried to conserve bandwidth as much as possible. Click on the image for an enlarged version of the letter.

A summary of the contents:

1. Washington Mutual accepts no responsibility for the protection of its customer's account.

2. The two phone-authorized checks we cashed against your account were valid "negotiable instruments" according to what is defined as a "demand draft" in Uniform Commercial Code 3104. Under this code, any check presented by a third party under your "purported authority" will be cashed.

3. A demand draft can be authorized by nothing more than one of our customers stating yes and confirming the city in which their account is held.

4. Washington Mutual's Forgery Department's responsibility is to place as much liability as possible on our customers. The Forgery Department is "very familiar" with telemarketing companies such as the one that defrauded you, yet Washington Mutual still unquestionly processes checks from them.

5. Washington Mutual is no different than other financial institution in accepting checks of this nature.

I give Washington Mutual and Mr. Samuel credit on two counts:

1. He wrote out a personally signed letter within 2 weeks of receiving my letter.

2. He answered each of the questions I raised.

I'm not satisfied by the response. In fact, I'm even more outraged by the grounds upon which Washington Mutual defends their acceptance of these checks. And his letter raises as many questions as it answers.

Mr. Samuel provides a phone number: 1-800-225-5497, option 2. I am going to write down my questions and contact him sometime in the coming week.

A summary of the contents:

1. Washington Mutual accepts no responsibility for the protection of its customer's account.

2. The two phone-authorized checks we cashed against your account were valid "negotiable instruments" according to what is defined as a "demand draft" in Uniform Commercial Code 3104. Under this code, any check presented by a third party under your "purported authority" will be cashed.

3. A demand draft can be authorized by nothing more than one of our customers stating yes and confirming the city in which their account is held.

4. Washington Mutual's Forgery Department's responsibility is to place as much liability as possible on our customers. The Forgery Department is "very familiar" with telemarketing companies such as the one that defrauded you, yet Washington Mutual still unquestionly processes checks from them.

5. Washington Mutual is no different than other financial institution in accepting checks of this nature.

I give Washington Mutual and Mr. Samuel credit on two counts:

1. He wrote out a personally signed letter within 2 weeks of receiving my letter.

2. He answered each of the questions I raised.

I'm not satisfied by the response. In fact, I'm even more outraged by the grounds upon which Washington Mutual defends their acceptance of these checks. And his letter raises as many questions as it answers.

Mr. Samuel provides a phone number: 1-800-225-5497, option 2. I am going to write down my questions and contact him sometime in the coming week.

Labels: wamu

Friday, March 24, 2006

weekly update

By necessity, I'm putting my campaign to get Grandma's money back into cruise control. But I'm still going to try to update this every week or two until I reach some kind of satisfactory resolution -- especially now that I'm starting to be contacted by people who have ended up on this site via major search engines.

Here's a summary of the responses (or lack of) that I've got from various companies and organization I've contacted in trying to resolve this:

Client Care Relations (1-866-898-7489)

Contacted them just now and simply asked for an update on my Grandma's refund check. Told by David Employee #533 (who I believe is the same person I spoke to last time) that check was cut and mailed on 3/6 and my Grandma should have it no later than Monday. This flatly contradicts what he told me last time so I suspect he is lying through his teeth.

Washington Mutual (1-866-513-9186)

No response yet to my letter.

Assemblywoman Lynn Daucher (website)

No response to email I sent her last week.

National Fraud Information Center (website)

No response to message I sent through their website.

Canadian Competition Bureau (website)

I received the following response on Mar 20:

I have received no further response.

Here's a summary of the responses (or lack of) that I've got from various companies and organization I've contacted in trying to resolve this:

Client Care Relations (1-866-898-7489)

Contacted them just now and simply asked for an update on my Grandma's refund check. Told by David Employee #533 (who I believe is the same person I spoke to last time) that check was cut and mailed on 3/6 and my Grandma should have it no later than Monday. This flatly contradicts what he told me last time so I suspect he is lying through his teeth.

Washington Mutual (1-866-513-9186)

No response yet to my letter.

Assemblywoman Lynn Daucher (website)

No response to email I sent her last week.

National Fraud Information Center (website)

No response to message I sent through their website.

Canadian Competition Bureau (website)

I received the following response on Mar 20:

Dear Mr. Withheld,

Your comment has been forwarded to the Fair Business Practices Branch of the Competition Bureau. Thank you.

Regards,

Information Officer

Your comment has been forwarded to the Fair Business Practices Branch of the Competition Bureau. Thank you.

Regards,

Information Officer

I have received no further response.

Monday, March 20, 2006

Response from AARP

A form letter by the looks of it, but some new leads (or links) which I may pursue if I find the time. They all sound a bit toothless. But that's one of the reasons I put together this blog -- so I can take full advantage of life in the age of digital reproduction and, rather than re-telling or re-writing out the whole sordid tale, just send them a link here.

I did fill out an NFIC Online Incident Report Form, but as with so many of these forms I've seen, it's unnecessarily long, ugly, and gives no assurance that it will prompt an immediate response. So I kept it simple:

Thank you for contacting AARP to ask for help in fighting consumer

fraud and for sharing your grandmother's story with us.

The Association is committed to providing information on all types of

consumer fraud. We invite you to visit the AARP website at

http://www.aarp.org/money/consumerprotection/scams/ for a host of

articles on the subject.

You may be interested in ordering our brochure, "The Top Frauds and

Scams" (D18110), or our companion publication, "Consumer Protection:

A Guide to Your Rights and Choices" (D17795). To order, send an

email to Member@AARP.org. Be sure to include publication titles and

stock numbers along with your complete name and mailing address. You

may also call us toll free at the number shown below, or write to us

at:

AARP Fulfillment

601 E Street, N.W.

Washington, DC 20049

If you have doubts about a sales pitch or suspect you are the victim

of fraud, there are several ways to report these incidents. We have

included a list of organizations and how to contact them that may

prove useful.

We hope this information is helpful. Thank you again for contacting

AARP.

_________________________________________________________

CONTACT INFORMATION

To report Internet and telemarketing fraud

National Fraud Information Center (NFIC)

c/o National Consumers League

1701 K Street, N.W., Suite1200

Washington, DC 20006

1-800-876-7060 (toll-free fraud hotline)

http://www.fraud.org/

To report all types of consumer fraud and order publications

Consumer Response Center

Federal Trade Commission (FTC)

600 Pennsylvania Avenue, N.W., Room H-130

Washington, DC 20580

1-877-382-4537

http://www.ftc.gov/ftc/consumer.htm

To report incidents to your state attorney general's office, check

the government pages of your area telephone book

National Association of Attorneys General (NAAG)

750 First Street, N.E., Suite 1100

Washington, DC 20002

1-202-326-6000

http://www.naag.org/

To report customs fraud, including people impersonating customs

agents

Customs Headquarters

1300 Pennsylvania Avenue, N.W.

Washington, DC 20229

1-800-232-5378

http://www.customs.ustreas.gov/

To report fraudulent business activity, check your area telephone

directory for a listing of your local Better Business Bureau, or

consider filing a complaint online

http://www.bbb.org/

To report fraudulent calls or mail coming from Canada

Project Phonebusters

1-888 495-8501

http://www.phonebusters.com/

Regards,

Ayan A.

Member Service

Member@aarp.org

Toll-free 1-888-OUR-AARP (1-888-687-2277)

Toll-free 1-877-434-7598 TTY

fraud and for sharing your grandmother's story with us.

The Association is committed to providing information on all types of

consumer fraud. We invite you to visit the AARP website at

http://www.aarp.org/money/consumerprotection/scams/ for a host of

articles on the subject.

You may be interested in ordering our brochure, "The Top Frauds and

Scams" (D18110), or our companion publication, "Consumer Protection:

A Guide to Your Rights and Choices" (D17795). To order, send an

email to Member@AARP.org. Be sure to include publication titles and

stock numbers along with your complete name and mailing address. You

may also call us toll free at the number shown below, or write to us

at:

AARP Fulfillment

601 E Street, N.W.

Washington, DC 20049

If you have doubts about a sales pitch or suspect you are the victim

of fraud, there are several ways to report these incidents. We have

included a list of organizations and how to contact them that may

prove useful.

We hope this information is helpful. Thank you again for contacting

AARP.

_________________________________________________________

CONTACT INFORMATION

To report Internet and telemarketing fraud

National Fraud Information Center (NFIC)

c/o National Consumers League

1701 K Street, N.W., Suite1200

Washington, DC 20006

1-800-876-7060 (toll-free fraud hotline)

http://www.fraud.org/

To report all types of consumer fraud and order publications

Consumer Response Center

Federal Trade Commission (FTC)

600 Pennsylvania Avenue, N.W., Room H-130

Washington, DC 20580

1-877-382-4537

http://www.ftc.gov/ftc/consumer.htm

To report incidents to your state attorney general's office, check

the government pages of your area telephone book

National Association of Attorneys General (NAAG)

750 First Street, N.E., Suite 1100

Washington, DC 20002

1-202-326-6000

http://www.naag.org/

To report customs fraud, including people impersonating customs

agents

Customs Headquarters

1300 Pennsylvania Avenue, N.W.

Washington, DC 20229

1-800-232-5378

http://www.customs.ustreas.gov/

To report fraudulent business activity, check your area telephone

directory for a listing of your local Better Business Bureau, or

consider filing a complaint online

http://www.bbb.org/

To report fraudulent calls or mail coming from Canada

Project Phonebusters

1-888 495-8501

http://www.phonebusters.com/

Regards,

Ayan A.

Member Service

Member@aarp.org

Toll-free 1-888-OUR-AARP (1-888-687-2277)

Toll-free 1-877-434-7598 TTY

I did fill out an NFIC Online Incident Report Form, but as with so many of these forms I've seen, it's unnecessarily long, ugly, and gives no assurance that it will prompt an immediate response. So I kept it simple:

If you are serious about pursuing this you'll read my detailed account of the fraud, the various parties involved, and what I've done to fight it on my site here:

http://wamublamesgrandma.blogspot.com/

The one thing that makes it worth reading: it does offer a clear and simple solution for preventing what appears to be a very common form of phone fraud targeting senior citizens.

http://wamublamesgrandma.blogspot.com/

The one thing that makes it worth reading: it does offer a clear and simple solution for preventing what appears to be a very common form of phone fraud targeting senior citizens.

Friday, March 17, 2006

Email to Assemblywoman Lynn Daucher

My grandmother passed along a postcard her local state assemblywoman, Lynn Daucher (72nd District - R), had sent her advertising a "Senior Scam Stopper Town Hall." I'd be really skeptical of getting much help out of a Republican politician -- or a Democratic politician, for that matter -- (but especially a Republican politican), given the fact that the scam that caught grandma can be traced back to corporate-lobby-written legislation like Check 21.

Nevertheless, I'm giving her the benefit of the doubt and sent the following note to her through her website:

I'll post any response I get here.

Nevertheless, I'm giving her the benefit of the doubt and sent the following note to her through her website:

My grandmother was recently scammed. I'm working on her behalf to try to right what happened.

She lives in Anaheim and recently received your mailing about your Senior Scam Stopper Town Hall.

She wanted me to share what I've done in response to what happened to her:

http://wamublamesgrandma.blogspot.com/

This scam looks like it targets seniors and appears to present a huge financial risk to people with checking accounts.

I hope my work is of some assistance. Please contact me at my email address if you have any questions.

She lives in Anaheim and recently received your mailing about your Senior Scam Stopper Town Hall.

She wanted me to share what I've done in response to what happened to her:

http://wamublamesgrandma.blogspot.com/

This scam looks like it targets seniors and appears to present a huge financial risk to people with checking accounts.

I hope my work is of some assistance. Please contact me at my email address if you have any questions.

I'll post any response I get here.

New Letter to Canadian Competition Bureau

Don't suspect this will have much effect, if any. But on the off-chance that the Bureau is compiling a dossier to file away for later review and perhaps reference in a government study or report someday, I wrote them another letter:

O, Canada... don't let me down.

I wrote you a couple weeks ago about a Canadian company, CCR, that works in league with scammers here in the US and helped defraud my grandmother of at least $798. I've been documenting my interactions with them so I won't repeat them here, but will refer you to my blog, where the facts are laid out in detail.

http://tinyurl.com/f5rzn

Please contact me if I may be of further assistance in penalizing or, ideally, putting these crooks out of business.

http://tinyurl.com/f5rzn

Please contact me if I may be of further assistance in penalizing or, ideally, putting these crooks out of business.

O, Canada... don't let me down.

Update on Refund from Client Care Relations

Last week I noted ("Refund in Process") I was told by Client Care Relations (CCR), 1-866-898-7489, the company that represents Identity Theft Prevention (ITP), the company that scammed my grandmother, that a refund was in process and she should be receiving a check within 7-10 business days.

I called back today to check up on the status of the refund check. To my utter shock and amazement, I learned that there had been a change in the status of the refund. David, employee #533, informed me that I had been misinformed by Louis (who really appeared at the time to have a very firm grasp of the process). A check has not yet been cut, much less mailed.

David stated that the check first would attempt to be directly deposited to my grandmother's Wamu account, which has now been closed of course. If that failed, then the process for cutting a refund check would start, but he did not know how long that would take or what exactly is involved. He said it could take several months.

A couple other interesting/disturbing facts I learned:

1. When I asked for the address of the company, he gave me a new address:

First Google result: www.actionseniors.org

My question: why is the Action Alliance of Senior Citizens of Greater Philadelphia partnering with these scoundrels?

I think I've found the answer: they're a front for this crooked company.

The web page list a phone number: 1-800-454-2290. I'm currently on hold with this number but there's no no sign that anyone is ever going to pick up.

2. He said there was also another case on record for my grandma dating back to 9/15/2005. This involved another CCR client, Priority Assistance Group, that charged or attempted to charge my grandmother $398 (forget 3 -- 398 must be the magic number) for Group Prescription coverage.

My grandma never made any reference to this, making me think one of two things happened:

1. When the company tried to cash this check, it got stopped in process -- perhaps by Wamu (which would only make their failure to do so in this instance all the more maddening.)

2. The check was cashed but my grandma either overlooked it (not likely) or was too embarrassed to mention it (which I doubt, too.)

In any event, a refund has been requested on that case, too. It's in process.

I am going to write to the Canadian Competition Bureau again and apprise them of the latest news on my dealings with CCR.

I called back today to check up on the status of the refund check. To my utter shock and amazement, I learned that there had been a change in the status of the refund. David, employee #533, informed me that I had been misinformed by Louis (who really appeared at the time to have a very firm grasp of the process). A check has not yet been cut, much less mailed.

David stated that the check first would attempt to be directly deposited to my grandmother's Wamu account, which has now been closed of course. If that failed, then the process for cutting a refund check would start, but he did not know how long that would take or what exactly is involved. He said it could take several months.

A couple other interesting/disturbing facts I learned:

1. When I asked for the address of the company, he gave me a new address:

1320 State Route #9

Champlaine, NY 12919

Champlaine, NY 12919

First Google result: www.actionseniors.org

My question: why is the Action Alliance of Senior Citizens of Greater Philadelphia partnering with these scoundrels?

I think I've found the answer: they're a front for this crooked company.

The web page list a phone number: 1-800-454-2290. I'm currently on hold with this number but there's no no sign that anyone is ever going to pick up.

2. He said there was also another case on record for my grandma dating back to 9/15/2005. This involved another CCR client, Priority Assistance Group, that charged or attempted to charge my grandmother $398 (forget 3 -- 398 must be the magic number) for Group Prescription coverage.

My grandma never made any reference to this, making me think one of two things happened:

1. When the company tried to cash this check, it got stopped in process -- perhaps by Wamu (which would only make their failure to do so in this instance all the more maddening.)

2. The check was cashed but my grandma either overlooked it (not likely) or was too embarrassed to mention it (which I doubt, too.)

In any event, a refund has been requested on that case, too. It's in process.

I am going to write to the Canadian Competition Bureau again and apprise them of the latest news on my dealings with CCR.

Thursday, March 16, 2006

Letter to AARP

As is probably obvious by this time, I have been making an active effort in my spare time to publicize this site and what happened. Today I wrote AARP through their website:

It's been about a week since I wrote Washington Mutual. I still have not received any response to my letter.

My grandmother was recently ripped off by some phone scammers. I investigated what happened and have been documenting what happened on my blog. The scammers are scum but what really maddened me was the way in which Washington Mutual (1) exposed my grandmother's checking account and (2) basically blamed her for what happened.

Full details here:

http://wamublamesgrandma.blogspot.com/

I get the feeling many seniors are being victimized by these kinds of scammers thanks to Wamu's check verification policies.

I hope that this can be of some help to your organization and its members.

I'm happy to answer any questions you may have.

Thanks,

Tom

Full details here:

http://wamublamesgrandma.blogspot.com/

I get the feeling many seniors are being victimized by these kinds of scammers thanks to Wamu's check verification policies.

I hope that this can be of some help to your organization and its members.

I'm happy to answer any questions you may have.

Thanks,

Tom

It's been about a week since I wrote Washington Mutual. I still have not received any response to my letter.

Wednesday, March 15, 2006

Status: Undeliverable as Addressed

End result of attempt to return scammers' package as instructed:

Your item was undeliverable as addressed at 1:20 pm on March 14, 2006 in LAS VEGAS, NV 89102. It is being returned if appropriate information is available.

WaMu's new ad campaign

You've probably seen the new commercials with the stodgy, old bankers in the basement that the Wamu spokesman says they are actively ignoring.

Here's the Adweek summary:

My question for Washington Mutual: was it one of those old bankers in the basement that told you not to accept checks like this?

If so, maybe you should hear out a few of their ideas. (One conclusion a cynic might draw from all of this: Washington Mutual doesn't mind sacrificing a few senior citizens if it serves the higher purpose of their own public image.)

A more detailed description of the new Wamu ad campaign can be found here:

Washington Mutual Launches National Advertising Campaign in Support of Its New WaMu Free Checking(TM) Account, Stirs Up the Industry

I suspect it has less to do with stirring up the industry than covering their ass(ets).

Here's the Adweek summary:

* CHICAGO Publicis Groupe's Leo Burnett depicts Washington Mutual using a captive focus group of stodgy, rich bankers to help guide its business decision in the agency's first work for the client.

* In television spots breaking today, the agency introduces the idea of the "banker's pen," where a pool of rich bankers is kept in the basement of a Washington Mutual branch.

* The new spots introduce a free checking product, which offers free ATM cash withdrawals, a free overdraft waiver, free checks for life and cash back for debit card use.

* In television spots breaking today, the agency introduces the idea of the "banker's pen," where a pool of rich bankers is kept in the basement of a Washington Mutual branch.

* The new spots introduce a free checking product, which offers free ATM cash withdrawals, a free overdraft waiver, free checks for life and cash back for debit card use.

My question for Washington Mutual: was it one of those old bankers in the basement that told you not to accept checks like this?

If so, maybe you should hear out a few of their ideas. (One conclusion a cynic might draw from all of this: Washington Mutual doesn't mind sacrificing a few senior citizens if it serves the higher purpose of their own public image.)

A more detailed description of the new Wamu ad campaign can be found here:

Washington Mutual Launches National Advertising Campaign in Support of Its New WaMu Free Checking(TM) Account, Stirs Up the Industry

I suspect it has less to do with stirring up the industry than covering their ass(ets).

Labels: wamu

Tuesday, March 14, 2006

Correction: Identity Theft Prevention

Someone pointed out that I've made several references to the company behind the scam that ripped off my company as Identity Theft Protection. As printed on the check, it should read Identity Theft Prevention. (My apologies to Identity Theft Protection.)

A small point, but one that might prove meaningful for anyone doing an internet search on them.

A small point, but one that might prove meaningful for anyone doing an internet search on them.

Monday, March 13, 2006

as dugg on digg

Thanks to my friend tidokoro for the digg plug. I added my own comment this morning. Thanks also for the label (

Thanks to my friend tidokoro for the digg plug. I added my own comment this morning. Thanks also for the label ( ) -- very cool.

) -- very cool.Also, I was surprised to find this story featured on the front page of consumerist.com. I sent off an email to them yesterday after hearing a story about their March Madness worst company tournament on the NPR show, Marketplace. I guess Wamu didn't make the tournament. Too bad, they've been playing like champions lately.

Also, regarding the Google Maps photo, I put up:

Someone on consumerist comments:

Google maps are routinely a block or two off. My home shows up as in the middle of the street a block behind us.

Good point. Someone else pointed this out to me after I originally posted it. Also, I'm aware that Google Maps photos are a little out-of-date. So it's possible that a thriving office complex sprung up on this lot within the last 6 months. Or that Identity Theft Protection is actually operating out of the McDonald's two doors down. If anyone in the neighborhood there is reading this and can check it out, please let us know.

Saturday, March 11, 2006

advice for dealing with unsolicited calls from banks

I could've sworn I was on the Do Not Call List. Whatever the case, Bank of America has been calling me a lot lately. I used to just tell them I wasn't in and offer to take a message when they asked for me. Now I say, "Good I'm glad you've called. I was just about to call you. I heard about all these pin numbers being stolen this week. Has my ATM card been compromised?"

Usually, they'll say something like, "Uh, you'll want to speak to another department," or, "Actually, I'm calling from the insurance company B of A has sold your personal information to," and give me a different number to call.

"Thank you. I'll do that now. Good bye." Click.

Actually, you could probably use this strategy with any unsolicited call -- not just banks. Just don't give them any personal information about you.

Usually, they'll say something like, "Uh, you'll want to speak to another department," or, "Actually, I'm calling from the insurance company B of A has sold your personal information to," and give me a different number to call.

"Thank you. I'll do that now. Good bye." Click.

Actually, you could probably use this strategy with any unsolicited call -- not just banks. Just don't give them any personal information about you.

Labels: CCR

Friday, March 10, 2006

follow-up on compromised Wamu debit cards

The day after I posted this this:

Compromised Wamu Debit Cards?

this story appeared on msnbc.com:

Debit card thieves get around PIN obstacle

From the article:

I explain in my post the way by which Wamu informed their customers of the breach (they didn't).

The whole article is worth reading, especially if you use a debit (as opposed to credit) card.

Compromised Wamu Debit Cards?

this story appeared on msnbc.com:

Debit card thieves get around PIN obstacle

From the article:

Several banks have made clear in their announcements that PINs were stolen and used to make fraudulent withdrawals.

I explain in my post the way by which Wamu informed their customers of the breach (they didn't).

The whole article is worth reading, especially if you use a debit (as opposed to credit) card.

Labels: wamu

Refund in Process

Client Care Relations (CCR), 1-866-898-7489, the company that represents Identity Theft Protect (ITP), the company that scammed my grandmother, claims that a refund of the full amount of my grandma's check (the first one) is now being processed by Paramount Processing, the company that handles their refund processing. Yes, the business partnerships are all rather amazingly octopussian in nature. All this to rip off senior citizens over the phone -- that's free market synergy for you!

My grandma's not counting her refund checks before their cashed, but I don't doubt that they are sending her a refund.

Why? Was I too harsh in judging these business as sleazy scam artists?

Of course not. They just don't want too much of a fuss. They have enough victims that roll over meekly or don't even know where to start in trying to recover their money, that it's much simpler for them to just sweep away the troublemakers as quickly as possible.

What's funny is CCR was originally telling me that I had to send the junk mail my grandmother received back to the fraud merchants at ITP and call them back with a mailing receipt number before they could start processing the refunds. However, I called today to confirm the mailing information and I was told that the refund was already in process and a check should reach my grandma within the next couple weeks.

I went ahead and sent the material back by certified mail to the address CCR originally gave me:

Identity Theft Protection

1117 Desert Lane #100

Las Vegas, NV 89102

I'm curious to see what happens to the package, since this is the latest Google satellite photo of that location:

My certified receipt number:

7005 3110 0002 2159 9452

Feel free to track along from home.

My grandma's not counting her refund checks before their cashed, but I don't doubt that they are sending her a refund.

Why? Was I too harsh in judging these business as sleazy scam artists?

Of course not. They just don't want too much of a fuss. They have enough victims that roll over meekly or don't even know where to start in trying to recover their money, that it's much simpler for them to just sweep away the troublemakers as quickly as possible.

What's funny is CCR was originally telling me that I had to send the junk mail my grandmother received back to the fraud merchants at ITP and call them back with a mailing receipt number before they could start processing the refunds. However, I called today to confirm the mailing information and I was told that the refund was already in process and a check should reach my grandma within the next couple weeks.

I went ahead and sent the material back by certified mail to the address CCR originally gave me:

Identity Theft Protection

1117 Desert Lane #100

Las Vegas, NV 89102

I'm curious to see what happens to the package, since this is the latest Google satellite photo of that location:

My certified receipt number:

7005 3110 0002 2159 9452

Feel free to track along from home.

Labels: CCR

Thursday, March 09, 2006

slashdot article on combating identity theft

Yesterday from slashdot:

My contribution to the post-article discourse:

not ID theft in the cool high tech sense, but...

I like the response:

Amen.

An anonymous reader writes "Net-Security is running an interesting article about some of the problems facing organizations when it comes to identity theft. From the article: 'Identity theft is the major security concern facing organizations today. Indeed, for the banking industry, it is the number one security priority for 2006. Identity security has developed beyond the simplest form of authentication where one party issues and verifies identities within a closed group of users. While easy to do, this approach is extremely hard and costly to scale upwards and offers no interoperability with other authentication networks.'"

My contribution to the post-article discourse:

not ID theft in the cool high tech sense, but...

I like the response:

Why is this surprising?

The US banking industry has documented policies that permit and encourage this to occur.

Get a 20th century banking system, and these incidents will stop virtually completely.

The US banking industry has documented policies that permit and encourage this to occur.

Get a 20th century banking system, and these incidents will stop virtually completely.

Amen.

Wednesday, March 08, 2006

postscript to letter

It is probably worth noting that when my mom contacted Wamu after my grandma discovered the first unauthorized check on her account, she requested that only checks signed by my grandmother be cashed. WM replied that this was not possible.

Also, when I tried to contact the number listed for verifying authorization on the second check (the PowerTamers one) (see below), I was dumped in a dead voicemail box. This suggests that Wamu in fact never even tried to verify the authenticity of the second check. I suppose it's possible that the number had been abandoned within the last couple weeks after WM had contacted someone and assured themselves of the check's authority -- or, more to the point, assured themselves that they could deny responsibility for cashing it. But I find it more probably that, like Stephen Jay Gould in that episode of the Simpsons with the angel bones, they simply never did the test.

Also, when I tried to contact the number listed for verifying authorization on the second check (the PowerTamers one) (see below), I was dumped in a dead voicemail box. This suggests that Wamu in fact never even tried to verify the authenticity of the second check. I suppose it's possible that the number had been abandoned within the last couple weeks after WM had contacted someone and assured themselves of the check's authority -- or, more to the point, assured themselves that they could deny responsibility for cashing it. But I find it more probably that, like Stephen Jay Gould in that episode of the Simpsons with the angel bones, they simply never did the test.

Letter to Fay L. Chapman, Senior Executive Vice President and General Counsel (unreformatted version)

Pasting this from Word -- haven't reformatted it for the web yet.

This might be considered the Long Version of what happened:

This might be considered the Long Version of what happened:

Fay L. Chapman

Senior Executive Vice President and General Counsel

Washington Mutual, Inc.

1201 Third Avenue, WMT 1501

Seattle, WA 98101

Forgery Department

Washington Mutual, Inc.

PO Box 201079, STA2FOR

Stockton, CA 95290

Re: My Grandmother, Case #200602xxxxx

Dear Ms. Chapman,

I'd like to share with you details of a fraud against my grandmother's Washington Mutual checking account. It resulted in her losing nearly $700 (about half her account balance) and led her to close her account and discontinue her business with Washington Mutual. I have spoken with representatives of Washington Mutual (WM) on your customer support phone line. I received incomplete and unsatisfactory answers to questions I raised about this incident. I was instructed to write this letter.

I am writing this letter as:

1. a concerned grandson

2. a Washington Mutual personal checking account holder myself

3. someone who would really like to see the type of people who victimized my grandmother and evidently make a career doing this put out of business

My grandmother is a responsible, independent, well-read 80 year-old widow. She still attends extension classes at her local university and is not a fool. She is not poor but lives in subsidized housing on fixed income. Her one failing: she was too polite to hang up on a phone solicitor and too trusting to recognize a scam in the making. After vainly filing a fraud claim with your Forgery Department, she closed her account and wisely decided to put this behind her as much as possible. It gives her a headache and, happily, she has better things to do with her time. Believe when I say I do as well. But she has given me her blessing in pursuing this matter and I have taken it up as a matter of civic responsibility if nothing else.

I have addressed this to you because I expect it will hold some special interest for you as an executive and general counsel for Washington Mutual or at least for someone who reports directly to you. I have also addressed it to Washington Mutual’s Forgery Department as advised, though I don’t have much confidence in the attention or helpfulness of this department for reasons explained below.

This is what happened, as best I can gather based on phone calls to representatives of the scammers, communications with Washington Mutual customer support, and conversations with my grandmother:

1. In December, she was phoned multiple times by men who possessed her account number and offered to credit her account in return for her cooperation in some kind of vague financial transaction. She admitted that it sounded “hokey,” but did not recognize it as a scam to defraud her account. She never wrote a check to them, never agreed to purchase anything, and never authorized them to withdraw funds from her account.

2. On December 22, Identity Theft Protection (ITP) printed a check in her name for the amount of $398. Though it was printed with her name, her (incomplete) street address, her account information, and Washington Mutual's name, it was not a check from her checkbook, she did not sign it, and it was cashed in Cleveland, OH, on the other side of the country. On December 28, WM processed the check and transferred the funds from her account.

3. The fraudulent transaction came to her attention at the end of January when she received her next statement from WM. She did not recognize the transaction and immediately phoned WM to report the unauthorized withdrawal. Around the same time, she received a package from a company named Identity Theft Protection in Las Vegas, NV. It contained generic brochures on identity theft and some miscellaneous junk mail. Apparently, this was the service or product the "merchants" presumed to offer my grandmother in return for her $398.

4. On February 14, the WM forgery department sent her an unsigned form letter stating that because the “merchant(s) in question voice-recorded the authorization for the transaction(s) in question,” her claim for reimbursement had been rejected. The letter went on to state, “In order to minimize the risk of future losses from against your compromised account, your account is scheduled to be closed with 15 business days from the date of this letter.” Because her social security checks must be directly deposited to an active account, she closed her account and opened a new one at a different bank with the assistance of her son and daughter (my mom) the following week.

5. Meanwhile, on February 7, after my grandmother had first reported the unauthorized withdrawal, WM honored another check for $299. Although the check was made out to a different company, the check otherwise looked identical to the first.

6. In recent days, I have contacted on several occasions a phone number listed on the first check. The number belongs to Client Care Relations, a Canadian firm that, according to agents with the company I have spoken to, represents over 60 firms. They would not give me any information on the company Identity Theft Protection that forged the check in my grandmother's name, but instructed me to send back the materials my grandmother had received by certified mail then call them back a week later with the receipt number and they would begin processing a refund with ITP. I am in the process of doing this. In phoning them, I also requested to hear the recorded authorization for the transaction. It was played for me and I maintain serious doubts about its authenticity. Client Care Relations claimed to have no knowledge of the second check and attempts to contact the number listed on the check end up in an anonymous voicemail box that is full and accepting no new messages.

7. Last week, I phoned Washington Mutual with my grandmother on the line to follow up on this matter. Before calling, I had drawn up a summary of events (like this one but much briefer) and questions regarding WM's policies and practice in handling my grandmother's account during these events. I spoke to two people who were unable to provide specific answers to my questions before being transferred to Jose Portilla who identified himself as a manager in the Forgery Department. He reiterated that my grandmother's forgery claim had been reviewed, rejected, and closed, and recommended I write this letter.

Listed below are the questions I wrote out before calling WM customer support and a summary of the responses I received:

1. These checks were not signed by my grandmother, did not originate from her checkbook or Washington Mutual, and were unlike any checks that have ever been written against her account before. Why did Washington Mutual honor them? What legitimate purpose could they possibly serve?

I never received a sensible answer to this question. I was informed that WM processed a number of these kinds of checks and they were processed automatically. The automatic acceptance of these checks seems to present a massive security risk for WM checking account holders.

2. What is the maximum amount for which Washington Mutual will automatically process with no additional security precautions?

I was told that there is no limit, only the funds available within the account. This surprised me.

3. How did Washington Mutual conduct their fraud investigation? What company did they contact? To whom did they speak?

The WM representative I spoke to could provide no details of how the investigation was conducted. The letter my grandmother received from WM's Forgery Department indicated only that the merchant possessed a voice recording authorizing the withdrawal and reprinted the phone number listed on the check.

4. The letter from WM's Fraud Department referred to a voice-recorded authorization. I have heard this recording. It sounded as though it had been both recorded out of context and doctored. How did WM's Fraud Department verify the authenticity of the recording?

WM reps could not answer this question and refused to allow me to speak to anyone in the department who might be able to answer it. Rather, both the phone agent Akiva and her manager Jose Portilla asked whether my grandmother had said her account number in the recording. I said that she had, but noted that she had not authorized the transaction. Both maintained that this was sufficient authorization. I reframed the question for Mr. Portilla:

5. Is it then the case that any merchant or criminal that records my grandmother saying her account number can print a check in her name and withdraw funds from her account in any amount?

He agreed that this was the case. I remain astounded. Mr. Portilla said at this point he could be of no further assistance and advised me to restate my concerns in writing.

From this interaction, I concluded the following:

1. Anyone can print up a check on my account in the way that these scammers did and Washington Mutual will process it and transfer the money from my account to theirs. The information required is public information and readily available -- anyone to whom I've written a check or who has served in the processing of that check necessarily has access to it. Because Washington Mutual accepts these dubious third-party checks, it is powerless to stop fraudulent checks in process.

2. If, after the fact, the scammers, con-men, or criminals can produce a recording in which I say my account number, regardless of the context, Washington Mutual will absolve itself of all responsibility for its role in the fraud by claiming that I “compromised my own account.”

Please correct me if I am wrong in any of these particulars. This however is the direct conclusion I drew from the very specific questions and concerns I raised with Washington Mutual support staff as they related to the forgery involving my grandmother.

As a Washington Mutual personal checking account holder myself, these revelations concern me immensely. Furthermore, Washington Mutual's apparent indifference in accepting suspicious checks and laxity in investigating claims of fraud strike me as the critical weakness in a system that appears to grossly benefit unscrupulous merchants and criminals who prey on senior citizens.

I feel compelled to add, as a final point, that having had to deal with customer service staff for both your company and representatives for the company that actively defrauded my grandmother, the latter proved on the whole more professional in tone and cooperative in nature. Despite my frustration with WM's actions, I made it a point to remain polite and civil through my conversation with your staff. The courtesy was not always returned.

Additionally, I found the process of navigating WM’s bureaucracy extraordinarily aggravating. My grandmother and I were transferred twice, with delays at each step. To finally be transferred to Jose Portilla required my grandmother and I to wait on hold for 15 minutes, without any warning of how long the wait would be or updates on when he would available to take our call. Perhaps this was a phone room vigilante's simple vindictiveness. But then when my grandmother and mom went to my grandmother's local branch to close her account, they had to wait a half-hour while one of your branch managers waited on hold on the phone herself for one of WM's own departments to unfreeze the account so that it might be closed. If this is not maverick pettiness of a few rogue employees within your company, you really need to give some attention to improving your internal organization.

While such service has not been my general experience as an account holder with your institution over the last several years, the exception in this case is almost strong enough to wipe out the effect of all the positive service I've experienced, not to mention all the Washington Mutual commercials I've seen, during that time.

I hope you or someone at Washington Mutual will be able to address in reasonable detail the questions and concerns about Washington Mutual check policy and account security that I have raised here. Mr. Portilla told me that it might require as much as 30 days for a response, but that I could expect a personal response. Considering the time and energy I have invested in this matter, I hope I may see a speedier reply. In any event, I hope my efforts will be of some service to both your institution and your account holders generally.

Sincerely,

wamuonfraud@gmail.com

Senior Executive Vice President and General Counsel

Washington Mutual, Inc.

1201 Third Avenue, WMT 1501

Seattle, WA 98101

Forgery Department

Washington Mutual, Inc.

PO Box 201079, STA2FOR

Stockton, CA 95290

Re: My Grandmother, Case #200602xxxxx

Dear Ms. Chapman,

I'd like to share with you details of a fraud against my grandmother's Washington Mutual checking account. It resulted in her losing nearly $700 (about half her account balance) and led her to close her account and discontinue her business with Washington Mutual. I have spoken with representatives of Washington Mutual (WM) on your customer support phone line. I received incomplete and unsatisfactory answers to questions I raised about this incident. I was instructed to write this letter.

I am writing this letter as:

1. a concerned grandson

2. a Washington Mutual personal checking account holder myself

3. someone who would really like to see the type of people who victimized my grandmother and evidently make a career doing this put out of business

My grandmother is a responsible, independent, well-read 80 year-old widow. She still attends extension classes at her local university and is not a fool. She is not poor but lives in subsidized housing on fixed income. Her one failing: she was too polite to hang up on a phone solicitor and too trusting to recognize a scam in the making. After vainly filing a fraud claim with your Forgery Department, she closed her account and wisely decided to put this behind her as much as possible. It gives her a headache and, happily, she has better things to do with her time. Believe when I say I do as well. But she has given me her blessing in pursuing this matter and I have taken it up as a matter of civic responsibility if nothing else.

I have addressed this to you because I expect it will hold some special interest for you as an executive and general counsel for Washington Mutual or at least for someone who reports directly to you. I have also addressed it to Washington Mutual’s Forgery Department as advised, though I don’t have much confidence in the attention or helpfulness of this department for reasons explained below.

This is what happened, as best I can gather based on phone calls to representatives of the scammers, communications with Washington Mutual customer support, and conversations with my grandmother:

1. In December, she was phoned multiple times by men who possessed her account number and offered to credit her account in return for her cooperation in some kind of vague financial transaction. She admitted that it sounded “hokey,” but did not recognize it as a scam to defraud her account. She never wrote a check to them, never agreed to purchase anything, and never authorized them to withdraw funds from her account.

2. On December 22, Identity Theft Protection (ITP) printed a check in her name for the amount of $398. Though it was printed with her name, her (incomplete) street address, her account information, and Washington Mutual's name, it was not a check from her checkbook, she did not sign it, and it was cashed in Cleveland, OH, on the other side of the country. On December 28, WM processed the check and transferred the funds from her account.

3. The fraudulent transaction came to her attention at the end of January when she received her next statement from WM. She did not recognize the transaction and immediately phoned WM to report the unauthorized withdrawal. Around the same time, she received a package from a company named Identity Theft Protection in Las Vegas, NV. It contained generic brochures on identity theft and some miscellaneous junk mail. Apparently, this was the service or product the "merchants" presumed to offer my grandmother in return for her $398.

4. On February 14, the WM forgery department sent her an unsigned form letter stating that because the “merchant(s) in question voice-recorded the authorization for the transaction(s) in question,” her claim for reimbursement had been rejected. The letter went on to state, “In order to minimize the risk of future losses from against your compromised account, your account is scheduled to be closed with 15 business days from the date of this letter.” Because her social security checks must be directly deposited to an active account, she closed her account and opened a new one at a different bank with the assistance of her son and daughter (my mom) the following week.

5. Meanwhile, on February 7, after my grandmother had first reported the unauthorized withdrawal, WM honored another check for $299. Although the check was made out to a different company, the check otherwise looked identical to the first.

6. In recent days, I have contacted on several occasions a phone number listed on the first check. The number belongs to Client Care Relations, a Canadian firm that, according to agents with the company I have spoken to, represents over 60 firms. They would not give me any information on the company Identity Theft Protection that forged the check in my grandmother's name, but instructed me to send back the materials my grandmother had received by certified mail then call them back a week later with the receipt number and they would begin processing a refund with ITP. I am in the process of doing this. In phoning them, I also requested to hear the recorded authorization for the transaction. It was played for me and I maintain serious doubts about its authenticity. Client Care Relations claimed to have no knowledge of the second check and attempts to contact the number listed on the check end up in an anonymous voicemail box that is full and accepting no new messages.

7. Last week, I phoned Washington Mutual with my grandmother on the line to follow up on this matter. Before calling, I had drawn up a summary of events (like this one but much briefer) and questions regarding WM's policies and practice in handling my grandmother's account during these events. I spoke to two people who were unable to provide specific answers to my questions before being transferred to Jose Portilla who identified himself as a manager in the Forgery Department. He reiterated that my grandmother's forgery claim had been reviewed, rejected, and closed, and recommended I write this letter.

Listed below are the questions I wrote out before calling WM customer support and a summary of the responses I received:

1. These checks were not signed by my grandmother, did not originate from her checkbook or Washington Mutual, and were unlike any checks that have ever been written against her account before. Why did Washington Mutual honor them? What legitimate purpose could they possibly serve?

I never received a sensible answer to this question. I was informed that WM processed a number of these kinds of checks and they were processed automatically. The automatic acceptance of these checks seems to present a massive security risk for WM checking account holders.

2. What is the maximum amount for which Washington Mutual will automatically process with no additional security precautions?

I was told that there is no limit, only the funds available within the account. This surprised me.

3. How did Washington Mutual conduct their fraud investigation? What company did they contact? To whom did they speak?

The WM representative I spoke to could provide no details of how the investigation was conducted. The letter my grandmother received from WM's Forgery Department indicated only that the merchant possessed a voice recording authorizing the withdrawal and reprinted the phone number listed on the check.

4. The letter from WM's Fraud Department referred to a voice-recorded authorization. I have heard this recording. It sounded as though it had been both recorded out of context and doctored. How did WM's Fraud Department verify the authenticity of the recording?

WM reps could not answer this question and refused to allow me to speak to anyone in the department who might be able to answer it. Rather, both the phone agent Akiva and her manager Jose Portilla asked whether my grandmother had said her account number in the recording. I said that she had, but noted that she had not authorized the transaction. Both maintained that this was sufficient authorization. I reframed the question for Mr. Portilla:

5. Is it then the case that any merchant or criminal that records my grandmother saying her account number can print a check in her name and withdraw funds from her account in any amount?

He agreed that this was the case. I remain astounded. Mr. Portilla said at this point he could be of no further assistance and advised me to restate my concerns in writing.

From this interaction, I concluded the following:

1. Anyone can print up a check on my account in the way that these scammers did and Washington Mutual will process it and transfer the money from my account to theirs. The information required is public information and readily available -- anyone to whom I've written a check or who has served in the processing of that check necessarily has access to it. Because Washington Mutual accepts these dubious third-party checks, it is powerless to stop fraudulent checks in process.

2. If, after the fact, the scammers, con-men, or criminals can produce a recording in which I say my account number, regardless of the context, Washington Mutual will absolve itself of all responsibility for its role in the fraud by claiming that I “compromised my own account.”

Please correct me if I am wrong in any of these particulars. This however is the direct conclusion I drew from the very specific questions and concerns I raised with Washington Mutual support staff as they related to the forgery involving my grandmother.

As a Washington Mutual personal checking account holder myself, these revelations concern me immensely. Furthermore, Washington Mutual's apparent indifference in accepting suspicious checks and laxity in investigating claims of fraud strike me as the critical weakness in a system that appears to grossly benefit unscrupulous merchants and criminals who prey on senior citizens.

I feel compelled to add, as a final point, that having had to deal with customer service staff for both your company and representatives for the company that actively defrauded my grandmother, the latter proved on the whole more professional in tone and cooperative in nature. Despite my frustration with WM's actions, I made it a point to remain polite and civil through my conversation with your staff. The courtesy was not always returned.

Additionally, I found the process of navigating WM’s bureaucracy extraordinarily aggravating. My grandmother and I were transferred twice, with delays at each step. To finally be transferred to Jose Portilla required my grandmother and I to wait on hold for 15 minutes, without any warning of how long the wait would be or updates on when he would available to take our call. Perhaps this was a phone room vigilante's simple vindictiveness. But then when my grandmother and mom went to my grandmother's local branch to close her account, they had to wait a half-hour while one of your branch managers waited on hold on the phone herself for one of WM's own departments to unfreeze the account so that it might be closed. If this is not maverick pettiness of a few rogue employees within your company, you really need to give some attention to improving your internal organization.

While such service has not been my general experience as an account holder with your institution over the last several years, the exception in this case is almost strong enough to wipe out the effect of all the positive service I've experienced, not to mention all the Washington Mutual commercials I've seen, during that time.

I hope you or someone at Washington Mutual will be able to address in reasonable detail the questions and concerns about Washington Mutual check policy and account security that I have raised here. Mr. Portilla told me that it might require as much as 30 days for a response, but that I could expect a personal response. Considering the time and energy I have invested in this matter, I hope I may see a speedier reply. In any event, I hope my efforts will be of some service to both your institution and your account holders generally.

Sincerely,

wamuonfraud@gmail.com

Labels: wamu

Compromised Wamu Debit Cards?

I was telling a friend of mine about my grandmother's experience this past weekend and she told me she had her own greivances to air about Wamu. Recently she was used her debit card at an ATM, but at the end of the transaction, the machine didn't return her card. She phoned customer support and was told a new one was already on its way. Shortly thereafter she received a new one in the mail, but the label had switched from Visa to Mastercard.

I told her it sounded fishy -- like Wamu had had an issue with the security on their Visa debit cards. One so serious, in fact, that they programmed their ATMs to issue an immediate recall on all cards so that, without any warning to their customers, ATM machines started swallowing the ATM cards.

This hypothesis receives some confirmation from a reader of this blog who contacted me to write that her Wamu account had been defrauded 3 times by a person or people using her debit card number. After her first two reports, she was issued a new card but within 30 days her account was hit again. The fraud stopped after she was issued another new card -- which she noted, after I shared with her my friend's tale -- had indeed switch from the Visa to the Mastercard label.

I only have an ATM card so this didn't affect me, but it appears Wamu didn't offer any notice about this to any of their debit card holders in any case.

Want more fear and dread about your personal security? Listen to this morning's interview with ChoicePoint marketing officer, James Lee, on NPR. What bullshit. The piece is titled "There Are Good Uses of Information, and Bad" on the NPR website, but, from the individual consumer's point-of-view, I have a hard time seeing the good the will come from a private corporation selling your personal information.

I told her it sounded fishy -- like Wamu had had an issue with the security on their Visa debit cards. One so serious, in fact, that they programmed their ATMs to issue an immediate recall on all cards so that, without any warning to their customers, ATM machines started swallowing the ATM cards.

This hypothesis receives some confirmation from a reader of this blog who contacted me to write that her Wamu account had been defrauded 3 times by a person or people using her debit card number. After her first two reports, she was issued a new card but within 30 days her account was hit again. The fraud stopped after she was issued another new card -- which she noted, after I shared with her my friend's tale -- had indeed switch from the Visa to the Mastercard label.

I only have an ATM card so this didn't affect me, but it appears Wamu didn't offer any notice about this to any of their debit card holders in any case.

Want more fear and dread about your personal security? Listen to this morning's interview with ChoicePoint marketing officer, James Lee, on NPR. What bullshit. The piece is titled "There Are Good Uses of Information, and Bad" on the NPR website, but, from the individual consumer's point-of-view, I have a hard time seeing the good the will come from a private corporation selling your personal information.

Labels: wamu

Tuesday, March 07, 2006

Public Comments

Update: since the site has been linked on dugg, I figure I'll make that the de facto forum for people wishing to comment on this site:

public comments on digg

public comments on digg

I've received a couple interesting notes from readers of this blog who have had their own problems with Washington Mutual. I've added this entry for the purpose of serving as a sort of forum for reader comments. I'll add a fixed link to the home page shortly.

Had a problem with a WaMu account or been scammed by crooks like my grandma? Perhaps you're a scammer or con man yourself? You're all welcome to comment here.

Monday, March 06, 2006

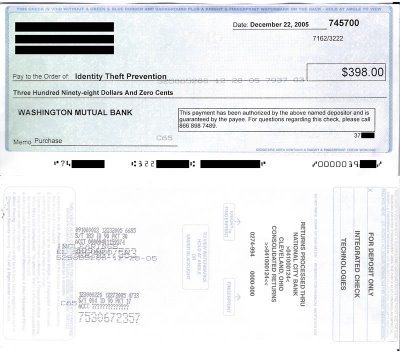

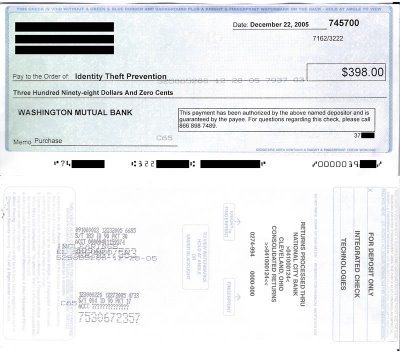

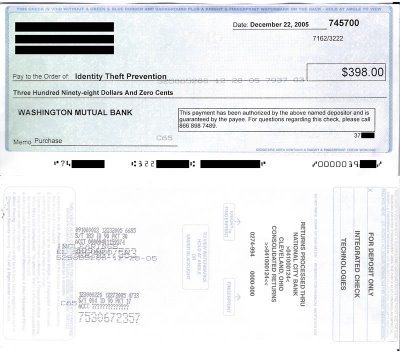

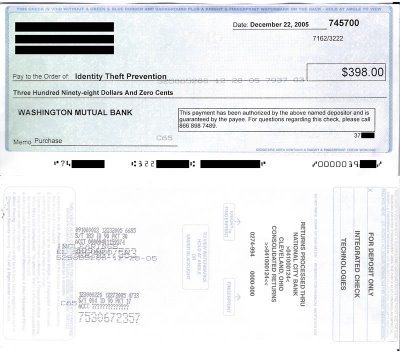

Check #1

With grandma's permission, here is the first check printed by the scammers and processed by WaMu to withdraw funds from grandma's account. I've black-barred my grandma's personal information and some numbers on the check to protect her identity as much as possible.

The three black bars at the upper right conceal her name and address (which was not entirely correct -- her apartment number was missing.) She said that they had her account number when they called.

Note: this is not a check from grandma's checkbook, there is no signature, no check like this had even been used by my grandma before, the check was printed by the scammers themselves, it was cashed at bank in Cleveland -- on the other side of the country. Yet WaMu still transferred the funds out of my grandma's account and called the transaction legitimate.

The three black bars at the upper right conceal her name and address (which was not entirely correct -- her apartment number was missing.) She said that they had her account number when they called.

Note: this is not a check from grandma's checkbook, there is no signature, no check like this had even been used by my grandma before, the check was printed by the scammers themselves, it was cashed at bank in Cleveland -- on the other side of the country. Yet WaMu still transferred the funds out of my grandma's account and called the transaction legitimate.

Correction

I originally wrote that grandma was swindled of nearly $600. Apparently, scammers can add better than I can -- it was actually close to $700. I've updated my summary above.

PowerTamers 877-436-5100

The original fraudulent activity on my grandmother's bank account in December came to her attention when she received her monthly statement from Washington Mutual at the end of January. She immediately phoned WM to initiate a fraud claim (which was rejected.) Yet, on February 2, a different company (in name at least) drew up a second check for $299 which, too, was unquestioningly processed by WM a couple days later and the funds transfered from my grandmother's account to some sleazeball affliliated with an account with National City Bank (no, the name doesn't make any sense to me either) in Cleveland, Ohio.

The check looks in every way identical to the first except for the name of the company to which it's paid, the memo (it says is for "Internet Services and Power Saver" -- my grandma does not have a computer) and the phone number in authorization statement on it, which reads

For the record, it was not guaranteed by the payee -- in fact, it was entirely unbeknownst to her -- and if you do have questions, call her first. Because if you call that number, you will get an automated system that eventually dumps you in a full voicemail box.

I'm going to call back later and record what happens and put a link to the file here. But first, I am going to try to get photos of the two checks uploaded later today.

If you're trying to learn more about PowerTamers, Google is not much help.

The check looks in every way identical to the first except for the name of the company to which it's paid, the memo (it says is for "Internet Services and Power Saver" -- my grandma does not have a computer) and the phone number in authorization statement on it, which reads

This payment has been authorized by the above name depositor and is guaranteed by the payee. For questions regarding this check, please call 877-436-5100.

For the record, it was not guaranteed by the payee -- in fact, it was entirely unbeknownst to her -- and if you do have questions, call her first. Because if you call that number, you will get an automated system that eventually dumps you in a full voicemail box.

I'm going to call back later and record what happens and put a link to the file here. But first, I am going to try to get photos of the two checks uploaded later today.

If you're trying to learn more about PowerTamers, Google is not much help.

Sunday, March 05, 2006

Uniform Commercial Code Article 3

My uncle -- who's been helping my grandmother get this mess sorted out -- pointed me to the UCC after he came across it on this site (ckfraud.org) while doing some research into check fraud. I told him I wouldn't be surprised if it turned out this site were run by a company like the one that ripped off Grandma. Still, it contained some useful information that helped point me to more reliable sources, like this Cornell University site on the UCC:

http://www.law.cornell.edu/ucc/3/3-406.html

Here's what I gather is the relevant legal code:

Good luck making that out! Whoever wrote that should be forced to sit on hold with Washington Mutual while they write that out 1000 times. Then they should be re-enrolled in a freshman university composition class.

After re-reading it several time, this is what I finally figured out it was probably trying to say (at least as it applies here):