WaMu Gave Grandma's Money to Crooks

special announcements

New York Times Reporting on ICT

The article appeared on May 21, 2007.

click here for more info

Monday, March 06, 2006

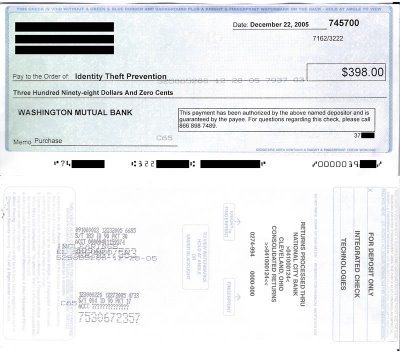

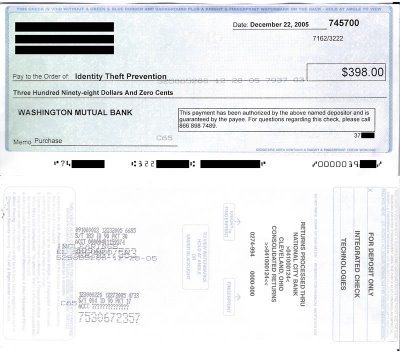

Check #1

With grandma's permission, here is the first check printed by the scammers and processed by WaMu to withdraw funds from grandma's account. I've black-barred my grandma's personal information and some numbers on the check to protect her identity as much as possible.

The three black bars at the upper right conceal her name and address (which was not entirely correct -- her apartment number was missing.) She said that they had her account number when they called.

Note: this is not a check from grandma's checkbook, there is no signature, no check like this had even been used by my grandma before, the check was printed by the scammers themselves, it was cashed at bank in Cleveland -- on the other side of the country. Yet WaMu still transferred the funds out of my grandma's account and called the transaction legitimate.

The three black bars at the upper right conceal her name and address (which was not entirely correct -- her apartment number was missing.) She said that they had her account number when they called.

Note: this is not a check from grandma's checkbook, there is no signature, no check like this had even been used by my grandma before, the check was printed by the scammers themselves, it was cashed at bank in Cleveland -- on the other side of the country. Yet WaMu still transferred the funds out of my grandma's account and called the transaction legitimate.

comments:

I'm sorry that happened to your grandma.

P@

www.rootsrocklive.com

Unfortunately I was asked to provide 3 personal security questions with 3 personal security answers, however I could not read the sentences listed on the menu, and therefore cannot answer the questions. Maybe it's my computer, but I doubt it.

Does anyone have the questions so I can get on with my life-Thanks

I would just call your bank's customer support -- they usually have an alternate way to verify your identity.

It's good that your bank is doing this -- that is, if it's really adding some security and not just a nuisance. I wonder if Wamu has started applying rules like this to the con artists sending in other people's check.